| End-User Guide > Desktop and Ribbon Bar > Loan Calculator |

The Loan Calculator allows users to calculate payment options and amounts outside of processing a loan application including solving for principal, number of payments, payment amount, and debt protection. The amortization results and amortization schedule are returned to the user.

|

In order to access and perform calculations from loan calculator, the Ad-hoc Loan Calculator permission must be set to Change for the user under the Origination Tools category of the Permissions tab in System Management > Users and System Management > Groups > Security Groups. If the user does not have permission to use the Ad-hoc Loan Calculator, a permission denied error is received upon trying to access the loan calculator in the Ribbon Bar. |

|

Calculations for Additional Principal Payments, as well as HOEPA and Military APR (MAPR), cannot be processed using the ad-hoc loan calculator. For more information on MAPR or HOEPA calculations, please see the Calculations for HOEPA APR section of the Loan Terms topic in this guide. |

Upon selecting the Loan Calculator icon, the Loan Calculator opens in a new window. The Loan Calculator contains a Toolbar located at the top of the window/screen. The Loan Calculator Toolbar contains the following icons:

| Icon | Description |

|

Allows a user to process a loan calculation based on the criteria entered in the Loan Calculator’s fields. |

|

Allows a user to Clear the search criteria entered in the Loan Calculator’s fields. |

|

Allows a user to cancel and close the Loan Calculator. |

The Loan Calculator contains two Panels: Inputs and Amortization.

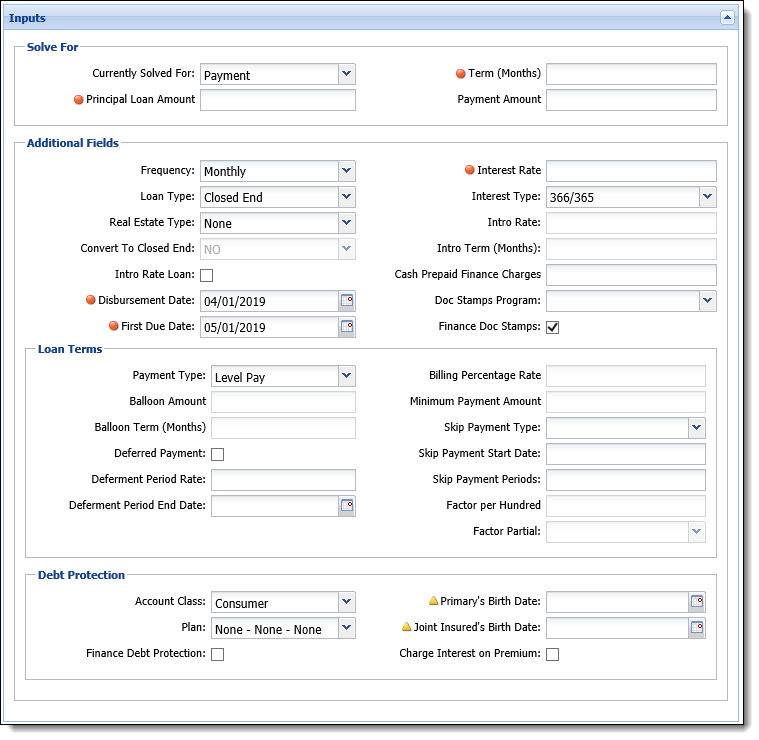

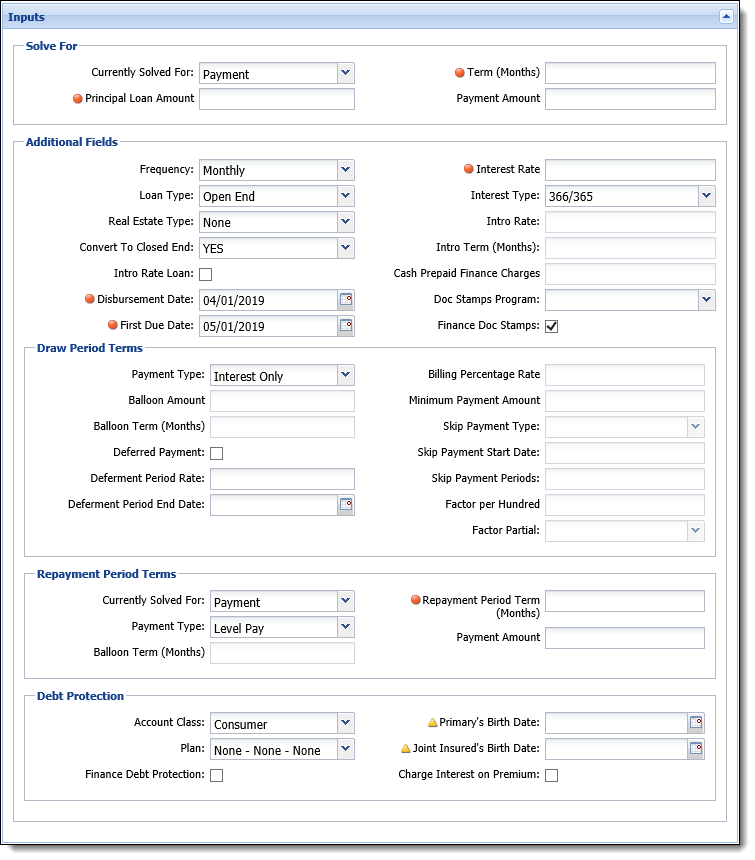

The Inputs panel is the section where users input the loan variables, such as Principal Loan Amount, Term, Interest Rate, and Debt Protection. The fields available in this panel are dependent on the value set within the Additional Fields section for Loan Type, Real Estate Type, and Convert to Closed End.

The following fields display when calculating a Closed End loan, or an Open End loan with Real Estate Type set to None, and Convert to Closed End set to No:

When calculating an Open End loan, two additional sections for Draw Period Terms and Repayment Period Terms populate in the Inputs panel, based on the value set for Real Estate Type and Convert to Closed End. These sections are available when Real Estate Type = Home Equity, or Real Estate Type = None and Convert to Closed End = Yes.

The following section provides information about the logic used for certain fields that appear within the Inputs panel of the Loan calculator:

|

Both the Charge Interest on Premium checkbox and Finance Debt Protection check box must be selected to include the amount of interest to be charged for a debt protection premium in the adhoc loan calculation. If Charge Interest on Premium is selected, but Finance Debt Protection is not, an error is received upon clicking  to identify that the payment protection must be financed or removed for military loans. to identify that the payment protection must be financed or removed for military loans. |

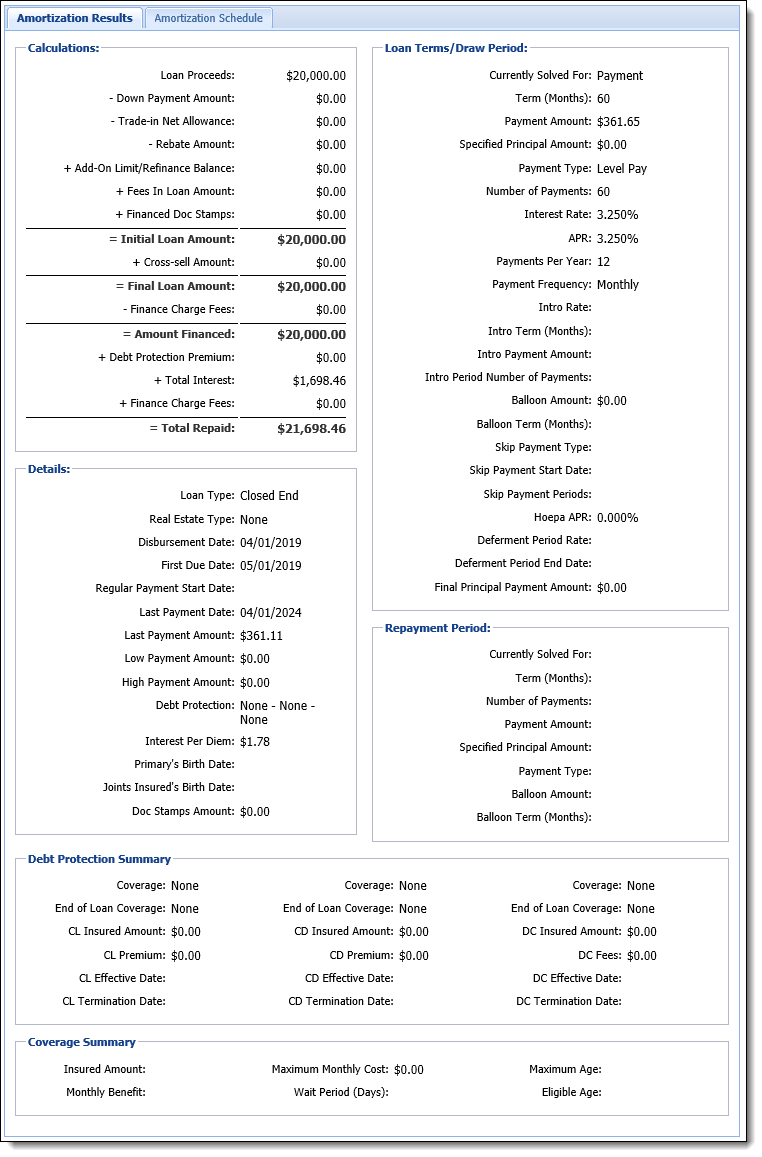

The Amortization panel displays the calculation results, which are based on the values entered in the Inputs panel. There are two tabs within the Amortization panel: Amortization Results and Amortization Schedule.

The Amortization Results tab displays the calculation results within summary panels that break down the calculation details.

|

The Loan Calculator uses the same logic as the CUNA Calculator. By design, the loan calculator purposely returns a value of 0.00% when calculating APR on Open-End loan applications. With the Credit CARD Act, the open-end APR calculation was replaced with the Fees and Interest section on a member’s periodic statement. On the open-end forms, there is a field called APR, but it is the Annual Interest Rate. |

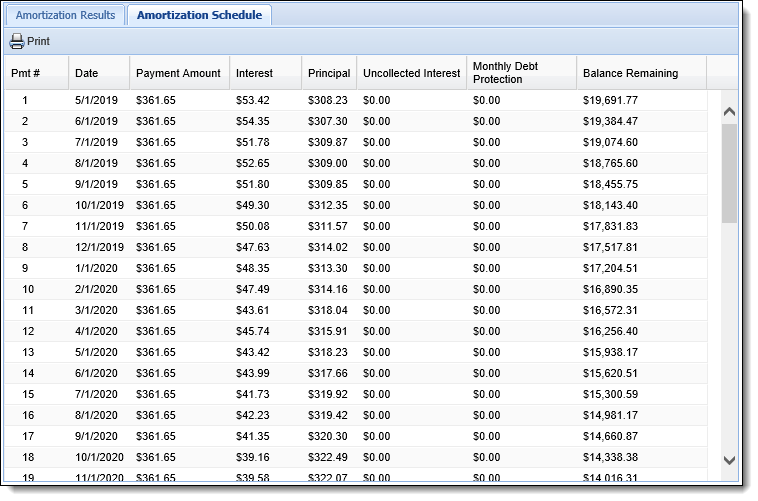

The Amortization Schedule tab displays the calculations results within a grid, which displays the loan repayment details.